By ED TRAVIS

Each January the National Golf Foundation (NGF) releases the golf industry Graffis Report and for 2025 several interesting facts popped out starting with the total number of participants reaching 48.1 million.

This count includes those playing on traditional golf courses and the exploding numbers of off-course players.

Participation growth from the pre-covid year of 2019 through last year was 41% while U.S. population grown was 4.1% which shows golf is a focus of a increasing and disproportionate segment of our society. Some commentators have ventured to call golf “cool” just like 25 years ago when Tiger Woods became the media darling capturing the attention of millions.

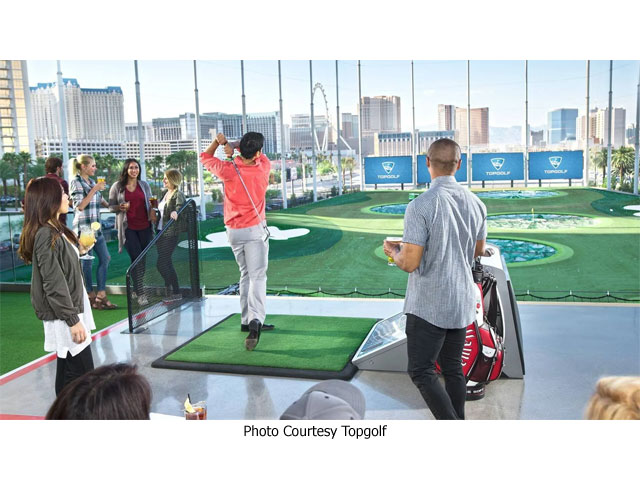

Off-course participation includes those smashing balls at golf entertainment centers such as Topgolf plus using driving ranges and indoor simulator screens. What is striking though is for each of the past four years off-course numbers have exceeded on-course players and doubled from 14.3 to 29.1 million.

What also caught my eye was though total participation in the past 10 years went from 31.1 million to 48.1 million; the number of people playing solely on-course went down by 3 million. It seems those taking up the game are doing it at golf entertainment centers, so that on-course play has been pushed to a secondary consideration. Those of us who play solely on green grass are a vanishing breed.

According to the NGF: “Green-grass golf participation surpassed 29 million in 2025 (all-time record is 30.6 million in 2003), marking an eighth consecutive year of growth and a net increase of roughly one million golfers YOY. Over the past eight years, on-course participation has risen by over five million, reinforcing that this is not a short-term COVID bump but a broader, lifestyle-driven shift toward experiences that deliver social connection, time outdoors, and physical, mental and emotional well-being.”

So, what’s the significance of all this? A couple of things. With the number of courses continuing to decline (averaging 1% net fewer per year) while the number of rounds played continues to increase (a record 550 million in 2025). We can therefore look for courses to be more crowded and greens fees to continue to go up. On that topic, public course greens are up 29% since 2019 while U.S. inflation has risen the same percentage so it seems golf facilities are at least keeping pace.

The rise in seasoned citizens (over 65) reflecting the aging of the baby-boomers is largest segment of those playing solely on-course and golf’s female participants have increased six years running. This has implications in new course construction, equipment sales and travel that are only beginning to be evaluated.

Greg Nathan, NGF President & CEO, wrote, “One could say golf is perfectly aligned with the kind of analog fulfillment people are seeking in an increasing frenetic digital world.” Like most pronouncements this may or may not be the case, but one thing is for sure the game of our fathers is becoming only a dim memory