Report Overview

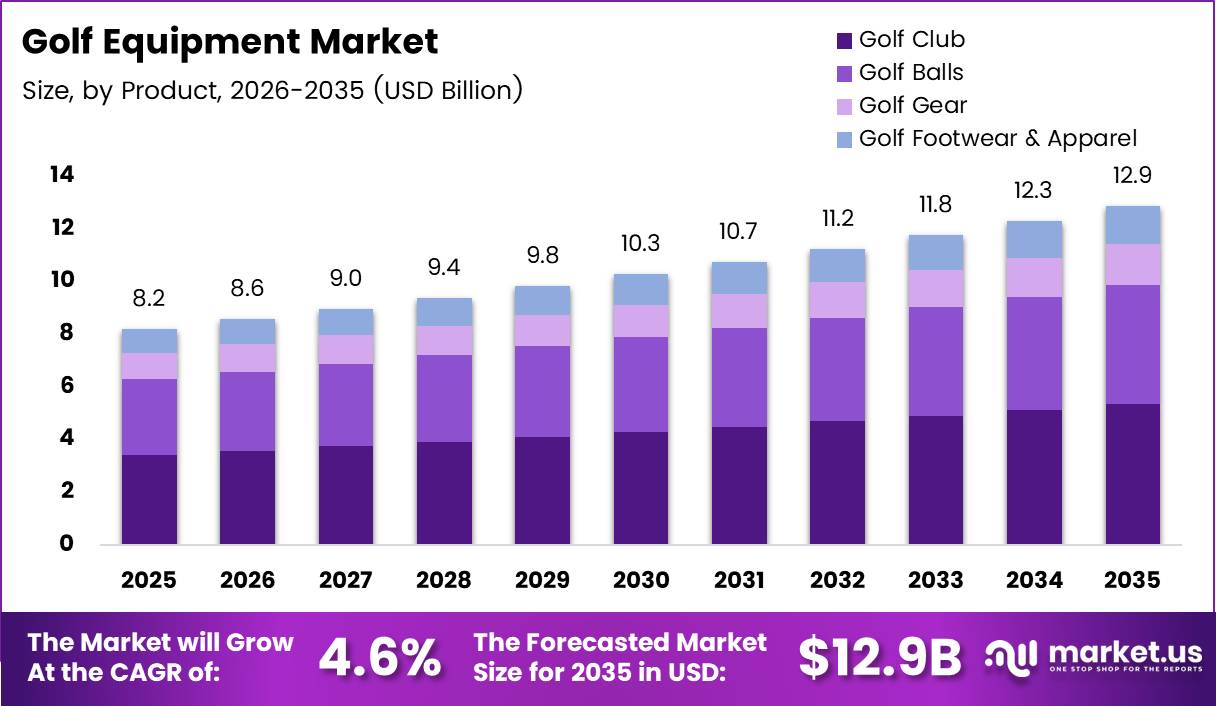

Global Golf Equipment Market size is expected to be worth around USD 12.9 Billion by 2035 from USD 8.2 Billion in 2025, growing at a CAGR of 4.6% during the forecast period 2026 to 2035.

Golf equipment encompasses clubs, balls, gear, footwear, and apparel designed for recreational and professional play. Players purchase these products through sporting goods retailers, online platforms, and on-course shops. The market serves both amateur and professional golfers worldwide.

Global participation in golf continues to expand across diverse demographics. Amateur leagues and golf tourism drive consistent equipment replacement cycles. Manufacturers focus on performance-enhancing technologies to attract serious players. Moreover, rising disposable incomes in emerging markets support premium product adoption.

Innovation shapes competitive differentiation within the industry. Smart golf clubs integrate sensors that track swing metrics and ball trajectory. Additionally, manufacturers develop personalized fitting services using advanced analytics. These technological improvements enhance player experience and justify premium pricing strategies.

Sustainability initiatives gain momentum across major equipment brands. Companies adopt eco-friendly materials in ball construction and club manufacturing. Furthermore, second-hand marketplaces provide affordable access to quality gear. This circular economy approach addresses both environmental concerns and budget constraints.

According to Acushnet’s corporate filing, total net sales across all golf-related products reached $2.5 billion in 2024. This performance demonstrates robust consumer demand despite economic headwinds. The golf balls segment alone generated approximately $786.5 million, representing a 3.3% increase versus 2023.

Digital transformation reshapes distribution channels and customer engagement. E-commerce platforms enable direct-to-consumer sales models that reduce intermediary costs. Additionally, augmented reality applications allow virtual equipment fitting from home. In January 2025, Pins & Aces acquired Edel Golf to strengthen its market position.

Female and youth participation rates accelerate market diversification. Manufacturers design gender-specific clubs and lighter equipment for younger players. Consequently, product portfolios expand beyond traditional offerings. This demographic shift creates sustained growth opportunities through 2035.

Key Takeaways

Global Golf Equipment Market is projected to reach USD 12.9 Billion by 2035, growing at a CAGR of 4.6% from 2025 to 2035

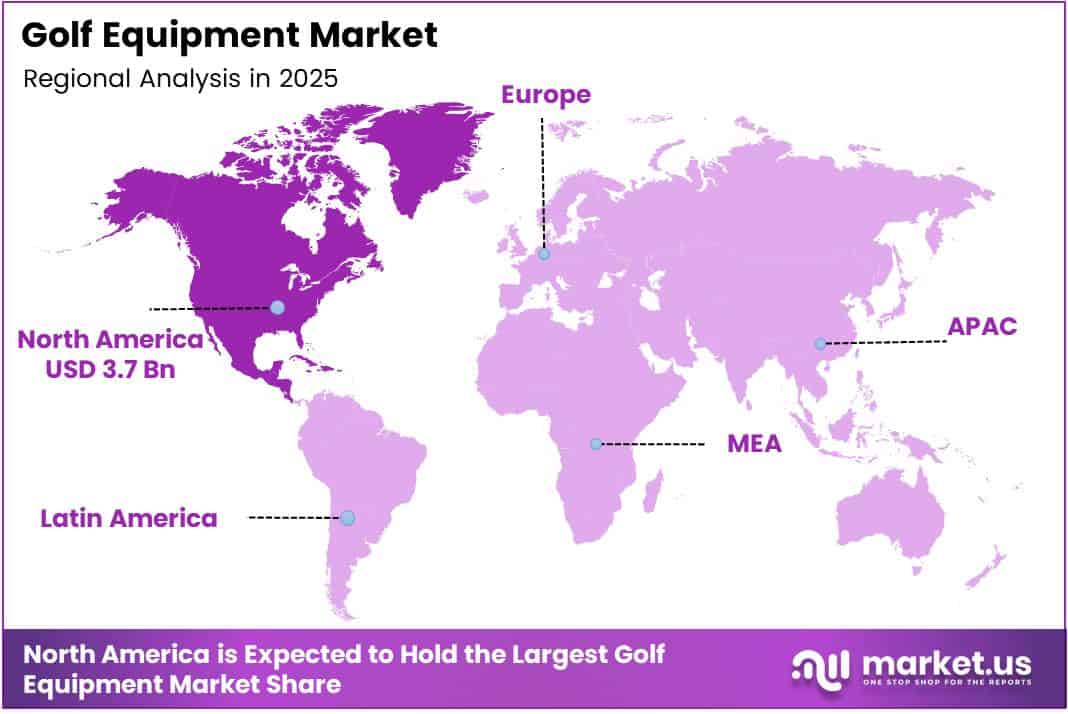

North America dominates the market with 45.80% share, valued at USD 3.7 Billion

Golf Club segment leads By Product category with 43.8% market share in 2025

Mass category holds 68.9% share in By Category segment, reflecting broad consumer accessibility

Amateurs represent 88.2% of end-users, driving volume-based equipment sales

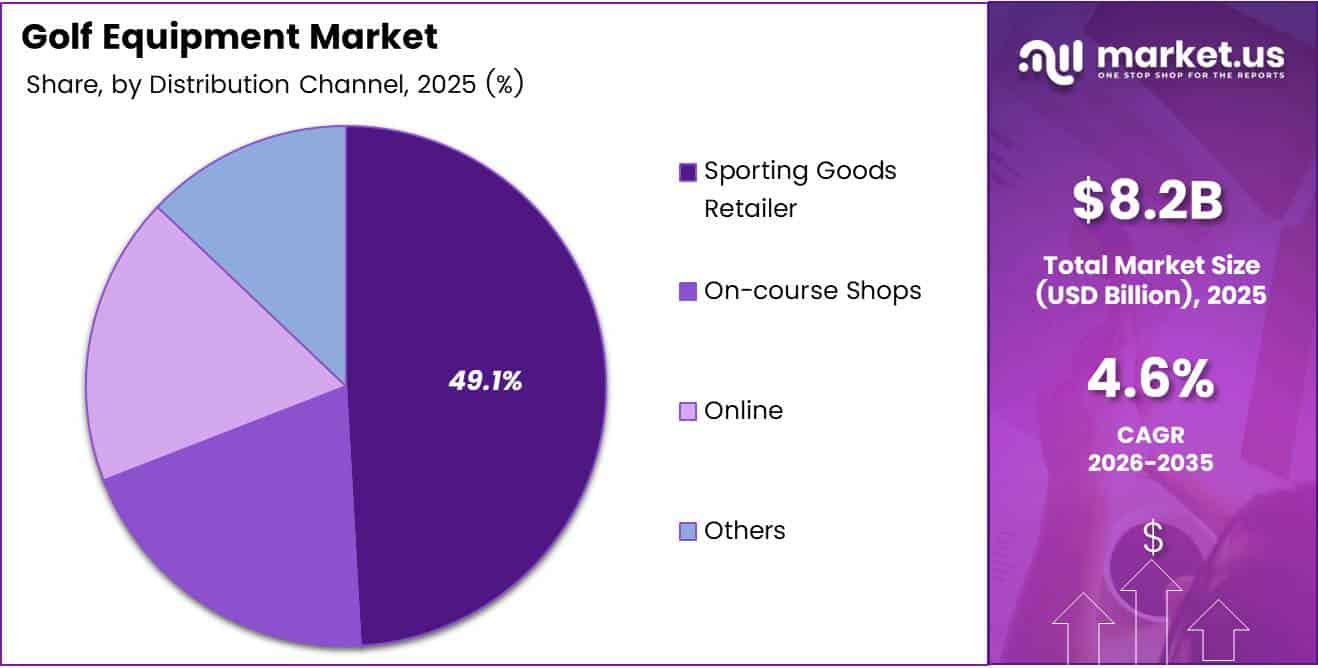

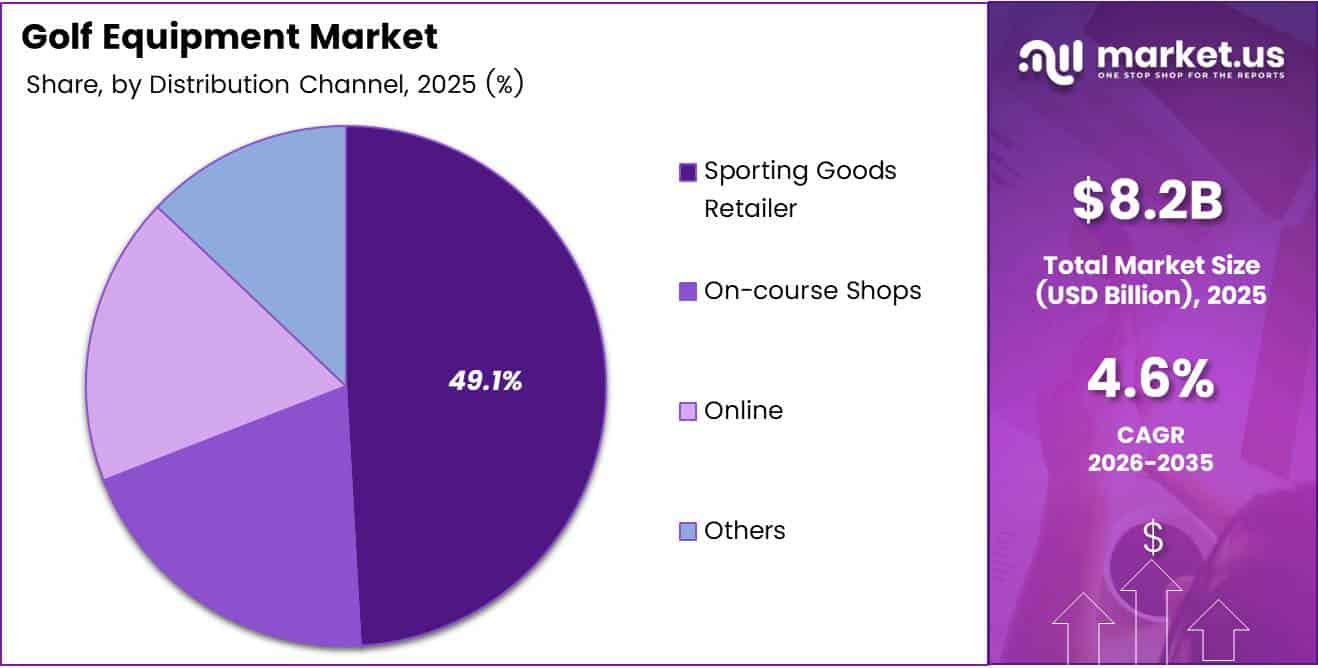

Sporting Goods Retailer channel captures 49.1% of distribution, maintaining traditional retail strength

Product Analysis

Golf Club dominates with 43.8% due to frequent replacement cycles and performance upgrades.

In 2025, Golf Club held a dominant market position in the By Product segment of Golf Equipment Market, with a 43.8% share. Players replace clubs regularly to access technological improvements in shaft materials and clubhead designs. Additionally, personalized fitting services encourage purchases of complete club sets tailored to individual swing characteristics.

Golf Balls maintain consistent demand across all skill levels and price segments. Manufacturers differentiate products through compression ratings, dimple patterns, and cover materials. Moreover, balls require frequent replacement due to wear and loss during play. This consumable nature generates recurring revenue streams for major brands.

Golf Gear includes bags, gloves, umbrellas, and training aids that enhance playing experience. Premium leather bags with advanced organization features attract serious golfers. Furthermore, smart training devices with swing analysis capabilities gain popularity. These accessories complement primary equipment purchases and improve overall market value.

Golf Footwear & Apparel combines performance functionality with style preferences across genders. Waterproof shoes with spiked or spikeless designs provide traction on various course conditions. Additionally, moisture-wicking apparel supports comfort during extended rounds. Fashion collaborations with lifestyle brands expand appeal beyond traditional golf demographics.

Category Analysis

Mass dominates with 68.9% due to affordability and accessibility for recreational players.

In 2025, Mass held a dominant market position in the By Category segment of Golf Equipment Market, with a 68.9% share. Recreational golfers prioritize value over premium features when purchasing equipment. Additionally, mass-market products provide adequate performance for casual play without significant investment. This segment drives volume sales through broad retail distribution networks.

Premium equipment targets serious amateurs and professionals seeking competitive advantages. Advanced materials like carbon fiber and titanium justify higher price points. Moreover, customization services allow precise adjustments to loft, lie, and shaft specifications. These offerings appeal to dedicated players willing to invest in performance optimization.

End-user Analysis

Amateurs dominate with 88.2% due to large recreational player base globally.

In 2025, Amateurs held a dominant market position in the By End-user segment of Golf Equipment Market, with an 88.2% share. Recreational players constitute the vast majority of golf participants worldwide. Additionally, amateur leagues and social golf events encourage equipment purchases. This segment exhibits diverse spending patterns across mass and premium categories.

Professionals represent a smaller but influential segment with specific performance requirements. Tour players test cutting-edge technologies that eventually reach consumer markets. Moreover, professional endorsements significantly impact brand perception and amateur purchasing decisions. These elite athletes drive innovation through demanding performance specifications.

Distribution Channel Analysis

Sporting Goods Retailer dominates with 49.1% due to physical product testing and expert advice.

In 2025, Sporting Goods Retailer held a dominant market position in the By Distribution Channel segment of Golf Equipment Market, with a 49.1% share. Customers value hands-on club testing and professional fitting services available in retail locations. Additionally, established retailers provide immediate product availability without shipping delays. This channel maintains trust through knowledgeable staff and comprehensive product selections.

On-course Shops capture impulse purchases and convenience sales for golfers during play. Pro shops stock essential items like balls, gloves, and tees for immediate needs. Moreover, course-specific branded merchandise appeals to members and visitors. These locations benefit from captive audiences actively engaged in the sport.

Online channels expand rapidly through direct-to-consumer brand websites and e-commerce platforms. Digital retailers offer competitive pricing and extensive product catalogs without physical space constraints. Furthermore, customer reviews and virtual fitting tools reduce purchase uncertainty. This channel attracts tech-savvy consumers comfortable with remote transactions.

Others include discount outlets, second-hand marketplaces, and specialty boutiques serving niche segments. Refurbished equipment platforms provide budget-friendly access to premium brands. Additionally, pop-up shops at tournaments create experiential marketing opportunities. These alternative channels supplement mainstream distribution networks.

Key Market Segments

By Product

Golf Club

Golf Balls

Golf Gear

Golf Footwear & Apparel

By Category

By End-user

By Distribution Channel

Sporting Goods Retailer

On-course Shops

Online

Others

Drivers

Rising Global Participation in Golf and Amateur Leagues Boosts Equipment Demand

Golf participation expands across emerging markets as disposable incomes rise and course accessibility improves. Amateur leagues organize regular tournaments that encourage equipment upgrades and replacement purchases. Additionally, corporate golf events drive group buying patterns. This grassroots growth sustains consistent demand across product categories.

Tourism-focused golf destinations attract international visitors who purchase equipment locally. Resort facilities offer rental programs that introduce players to new brands and technologies. Moreover, golf course expansions in Asia-Pacific regions create infrastructure supporting sustained market growth. According to Acushnet’s filing, golf clubs generated approximately $721.3 million, up 9.5% versus 2023.

Innovation in smart clubs and performance-enhancing balls attracts tech-savvy consumers. Manufacturers integrate sensors tracking swing speed, ball spin, and launch angles. Furthermore, data analytics platforms provide personalized improvement recommendations. These technological advancements justify premium pricing and accelerate replacement cycles among serious players.

Restraints

High Cost of Premium Golf Equipment Limits Affordability for Emerging Markets

Premium golf clubs and complete equipment sets require substantial upfront investment. Price-sensitive consumers in developing regions cannot justify spending on high-end brands. Additionally, import tariffs and currency fluctuations increase costs in international markets. This affordability barrier restricts market penetration beyond affluent demographics.

Seasonal demand fluctuations create inventory management challenges for manufacturers and retailers. Weather dependency limits playing opportunities in northern climates during winter months. Moreover, inconsistent sales patterns complicate production planning and distribution strategies. Consequently, businesses face cash flow constraints during off-peak periods.

Economic downturns reduce discretionary spending on recreational equipment and leisure activities. Consumers defer equipment upgrades when financial uncertainty prevails. Furthermore, course closures during recessions decrease playing frequency and purchase motivation. These cyclical challenges require strategic pricing adjustments and promotional campaigns.

Growth Factors

Technological Advancements Accelerate Market Expansion

E-commerce platforms eliminate geographic barriers and expand customer reach globally. Direct-to-consumer models reduce distribution costs and improve profit margins for manufacturers. Additionally, subscription services deliver golf balls and accessories on recurring schedules. According to Acushnet’s filing, Titleist golf equipment totaled approximately $1,507.8 million, up 6.2% in 2024.

IoT and AI technologies transform training aids and swing analyzers into sophisticated learning tools. Smart devices provide real-time feedback that accelerates skill development for amateurs. Moreover, virtual coaching applications connect players with professional instructors remotely. In December 2024, TaylorMade Golf acquired Logan Olson to expand its putter category capabilities.

Customization services differentiate premium brands through personalized club specifications and aesthetic options. Players select shaft flex, grip size, and clubhead weight to match their swing characteristics. Furthermore, laser engraving and custom paint fills create unique visual identities. Strategic partnerships with professional players generate endorsed product lines that attract aspirational buyers.

Emerging Trends

Sustainability-Focused Golf Equipment Using Eco-Friendly Materials

Manufacturers adopt biodegradable materials in golf ball construction to reduce environmental impact. Recycled plastics and plant-based polymers replace traditional petroleum-derived components. Additionally, sustainable packaging initiatives eliminate single-use plastics. These environmental commitments resonate with environmentally conscious consumers.

Influencer collaborations and golf content creators expand brand visibility among younger demographics. Social media personalities demonstrate equipment performance through engaging video content. Moreover, lifestyle-focused marketing positions golf as accessible beyond traditional country club settings. This cultural shift attracts diverse participants previously intimidated by sport’s exclusivity.

Second-hand marketplaces provide certified pre-owned equipment at accessible price points. Refurbishment programs restore used clubs to near-new condition with warranties. Furthermore, trade-in programs encourage upgrades while giving older equipment new life. Augmented reality applications enable virtual club fitting from home, reducing need for retail visits.

Regional Analysis

North America Dominates the Golf Equipment Market with a Market Share of 45.80%, Valued at USD 3.7 Billion

North America maintains market leadership with 45.80% share, valued at USD 3.7 Billion, driven by established golf culture and high participation rates. The United States hosts the largest concentration of golf courses and country club memberships globally. Additionally, professional tours and media coverage sustain consumer engagement year-round. Premium equipment adoption remains strong among affluent players.

Europe Golf Equipment Market Trends

Europe demonstrates steady growth through traditional golf strongholds in United Kingdom and emerging markets in Southern Europe. Scottish and Irish courses attract international tourism that supports local equipment sales. Moreover, Ryder Cup events generate periodic demand spikes. Mediterranean climate zones extend playing seasons compared to northern regions.

Asia Pacific Golf Equipment Market Trends

Asia Pacific experiences rapid expansion as middle-class populations embrace golf as status symbol and business networking tool. China and South Korea invest heavily in course development and junior programs. Additionally, Japanese manufacturers maintain technological leadership in club design. Rising female participation diversifies product portfolios across the region.

Latin America Golf Equipment Market Trends

Latin America shows modest growth concentrated in Brazil and Mexico where resort golf attracts domestic and international players. Economic volatility constrains premium equipment adoption among price-sensitive consumers. However, golf tourism initiatives supported by governments encourage infrastructure development. Online channels expand access in areas lacking specialty retailers.

Middle East & Africa Golf Equipment Market Trends

Middle East & Africa represents emerging opportunity with luxury golf developments in Gulf Cooperation Council nations. Dubai and Abu Dhabi position golf as key tourism differentiator. Moreover, South African golf heritage supports established player base. However, limited course access outside major cities restricts mass-market growth.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Company Insights

Callaway maintains competitive positioning through continuous innovation in driver and iron technologies that enhance distance and forgiveness. The company invests heavily in research and development to create differentiated products for various skill levels. Additionally, strategic acquisitions expand its portfolio into apparel and accessories. Strong tour presence through professional endorsements reinforces brand credibility.

Acushnet Holding Corp. operates the prestigious Titleist and FootJoy brands serving serious golfers and professionals. According to corporate filings, golf gear including bags and accessories generated approximately $232.1 million, up 4.3% in 2024. The company emphasizes precision manufacturing and performance consistency that justify premium pricing. Moreover, extensive fitting networks provide personalized service experiences.

TaylorMade leads technological innovation with adjustable club systems and carbon-composite constructions. The brand dominates metalwood categories through aggressive marketing and tour player adoption. Additionally, direct-to-consumer digital channels strengthen customer relationships and improve margins. Recent putter category expansion through acquisition demonstrates strategic diversification.

Titleist commands loyalty among better players through reputation for quality and performance reliability. The brand’s golf balls remain preferred choice on professional tours worldwide. Moreover, comprehensive club offerings from wedges to drivers serve complete equipment needs. FootJoy golf wear contributed approximately $574.6 million despite slight decline versus 2023.

Key players

Callaway

SRI Sports Limited

Acushnet Holding Corp.

Taylormade

Titleist

Mizuno

Wilson

Ping

Recent Developments

January 2026 – Advanced Turf Solutions acquires Long Island, NYC distributor to expand regional market presence and strengthen distribution capabilities in the northeastern United States golf equipment market.

July 2025 – L.A.B. Golf is acquired by L Catterton, a leading global investment firm, providing capital and strategic resources to accelerate growth in the premium putter segment.

January 2026 – P53 acquires golf club manufacturing and chroming assets from Arizona-based The Iron Factory, Inc., enhancing production capacity and vertical integration for custom club finishing services.

Report Scope