The 2025 Golfshake Club Membership Survey has now concluded, with over 2,500 golfers taking part in October 2025. Following last year’s successful survey, this new round of research provides a fascinating year-on-year comparison that analyses the data and changing insights, spending habits and experiences of golfers across the UK.

This article is the first in a series exploring the data in detail, beginning with an overview of membership trends, costs, and participation sentiment. Once again, the results paint an encouraging picture for the game, though not without a few areas that deserve closer attention from clubs and the wider golf industry.

Golfshake Survey Demographic

(Image Credit: Kevin Diss Photography)

Unsurprisingly golf club membership remains strong among those golfers completing the survey.

86% of respondents were golf club members, up from 84% in 2024. 3% plan to join a club soon, same as 2024. 2% said they had stopped membership in the past year, same as 2024.

This data reaffirms the strength of the survey data from a passionate and long-standing membership base: half of all respondents (50%) have been members at their current club for more than 10 years, up from 46% last year.

Membership Costs Continue to Rise

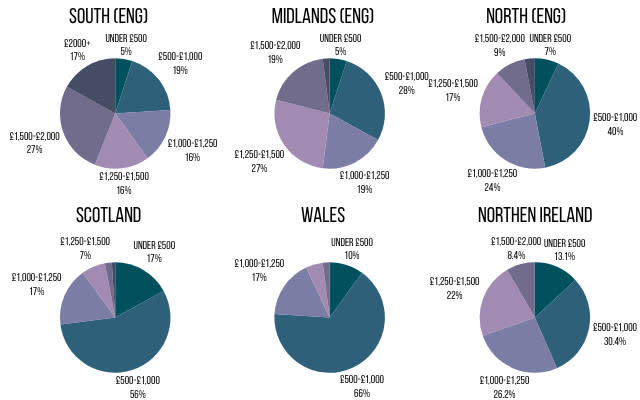

As expected, club membership costs continue their upward trend. The proportion of golfers paying less than £1,000 per year fell to 41%, compared to 47% in 2024. While this is not surprising given inflationary pressures and rising facility costs, it highlights the need for clubs to clearly communicate the value they offer.

The following regional analysis breaks down the costs across the key regions in the UK:

Despite higher costs, satisfaction remains steady:

71% of golfers say membership still offers good value for money, up slightly from 69% last year. Those saying no” declined to 15% (from 16%), while the remainder were unsure.

However, communication remains an issue. Among those whose membership fees increased, 31% still said their club did not explain the reason for the rise, this was up from 30% in 2024. Transparency here could help maintain trust during an era of persistent price increases.

Looking ahead, expectations for further rises remain widespread. 81% of golfers expect their membership costs will increase again in 2026, compared with 7% who expect them to stay the same.

Demand Remains High

Demand for golf club membership continues to be robust:

30% of golfers reported their club has a waiting list, up from 27%. 39% said their club now charges a joining fee, up from 37%.

Such figures suggest that despite cost pressures, the appetite for club membership remains strong.

How Are Golf Clubs Performing in 2025?

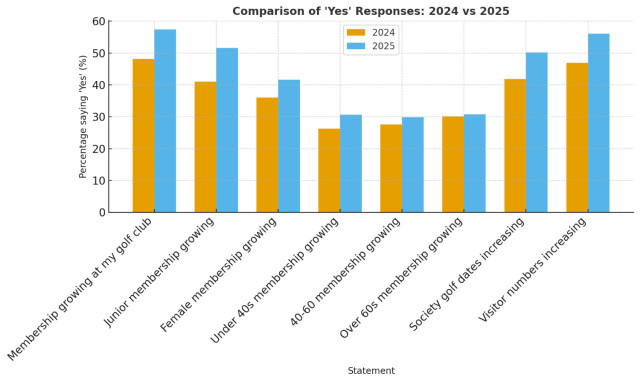

Respondents were also asked to share their perceptions of club growth – specifically whether they believed various segments of membership and participation were increasing. The table below compares the 2025 and 2024 findings.

Comparison of Golf Club Membership Perceptions (2025 vs 2024) Statement Yes 2025 Yes 2024 Change No 2025 No 2024 Not Sure 2025 Not Sure 2024 Membership is growing at my golf club 57.4% 48.14% +9.26 20.64% 24.79% 21.96% 27.07% Junior membership is growing 51.58% 41.06% +10.52 18.41% 24.38% 30.02% 34.56% Female membership is growing 41.59% 36.01% +5.58 23.67% 28.13% 34.73% 35.86% Under 40s membership is growing 30.63% 26.26% +4.37 15.87% 19.46% 53.49% 54.28% 40–60 membership is growing 29.85% 27.57% +2.28 14.14% 18.38% 56.01% 54.06% Over 60s membership is growing 30.73% 30.18% +0.55 22.12% 21.17% 47.15% 48.65% Society golf dates are increasing 50.17% 41.86% +8.31 18.85% 21.29% 30.99% 36.85% Visitor numbers are increasing 56.10% 46.91% +9.19 13.42% 16.79% 30.48% 36.30% Key Insights

All indicators point in a positive direction. Every statement saw an increase in the percentage of golfers saying yes”, with corresponding declines in “no” and “not sure” responses.

Overall membership growth is up nearly 10 percentage points year-on-year. Junior participation recorded the biggest gain (+10.5pp). Female membership continues its steady rise.

The only area showing limited movement was growth among over-60s, where perceptions remained largely unchanged, perhaps reflecting already-high participation in that group.

Will Golfers Renew in 2026?

This was a question we recently posed in a feature article, but encouragingly, commitment remains strong.

77% of golfers plan to renew their membership next year. Only 4% said they would not renew. 19% are undecided, identical figures to 2024.

This consistency suggests that despite higher costs, golfers still see significant value in club membership.

Engagement, Experience & Spending

Tee-time availability has improved slightly, with 74% of respondents now finding it easy to book their preferred slot (up from 71%). Those struggling to secure times ticked up marginally from 5% to 6%, while “sometimes” responses fell from 24% to 20% – implying better overall access.

Pace of play also improved, with 48% satisfied with course speed compared to 43% in 2024. Dissatisfaction dropped from 26% to 24%, reflecting ongoing efforts by clubs to manage course flow more effectively.

Off the course, the clubhouse remains a key social hub:

61% spend £5-£15 after a round. 15% spend under £5, while 8% don’t visit the clubhouse at all.

When it comes to retail behaviour, 56% of golfers purchased equipment online in the past year, 53% from their Pro Shop, and 45% from retail stores. However, only 42% of those completing the survey said their local Pro Shops price-match online or retail competitors.

What is the outlook of golfers for the 2026 season?

One subtle shift in sentiment: only 43% of golfers now say they want to play more golf next year, compared to 51% in 2024. While this doesn’t necessarily signal waning enthusiasm, it may reflect the challenges of balancing time, cost, and access in a busy post-pandemic world.

Overall, the data presents an encouraging picture. The club game remains resilient, in demand, and broadly optimistic, with steady growth across key demographics and sustained loyalty from existing members. As costs continue to rise, clear communication and visible value will be crucial to maintaining this momentum through 2026 and beyond.

Next week, we’ll step beyond the data to explore the comments and feedback shared by golfers themselves – offering valuable, unfiltered insights straight from the voice of everyday golfers.