Recent updates indicate continued solid demand in the leisure and recreation products sector, driven by rising health and fitness awareness benefiting companies like Acushnet Holdings. This broader industry momentum is positioning Acushnet to capture opportunities amid consumer interest in outdoor and premium recreation goods. We’ll explore how the sustained positive trend in health and fitness product sales may alter Acushnet’s investment outlook and risk profile.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

Acushnet Holdings Investment Narrative Recap

To consider holding Acushnet Holdings, one must believe in the long-term rise of health and fitness culture and its positive effect on leisure and recreation brands. The latest sector news confirms sustained demand industry-wide, but it does not materially impact the company’s current key growth catalyst: steady golf participation rates and premium product launches. The main risk, potential plateauing or reversal in golf activity levels, remains unchanged in the near term, despite positive macro trends.

Among Acushnet’s recent announcements, the continued upward trend in quarterly dividends, with the latest payout scheduled for August 2025, is the most relevant. This steady capital return policy is a clear signal that the board remains confident in the company’s cash flow resilience and ability to pass value back to shareholders, and it aligns directly with the ongoing industry demand and margin stability that support its near-term outlook.

Yet, despite headline growth for leisure products, investors should also keep an eye on…

Read the full narrative on Acushnet Holdings (it’s free!)

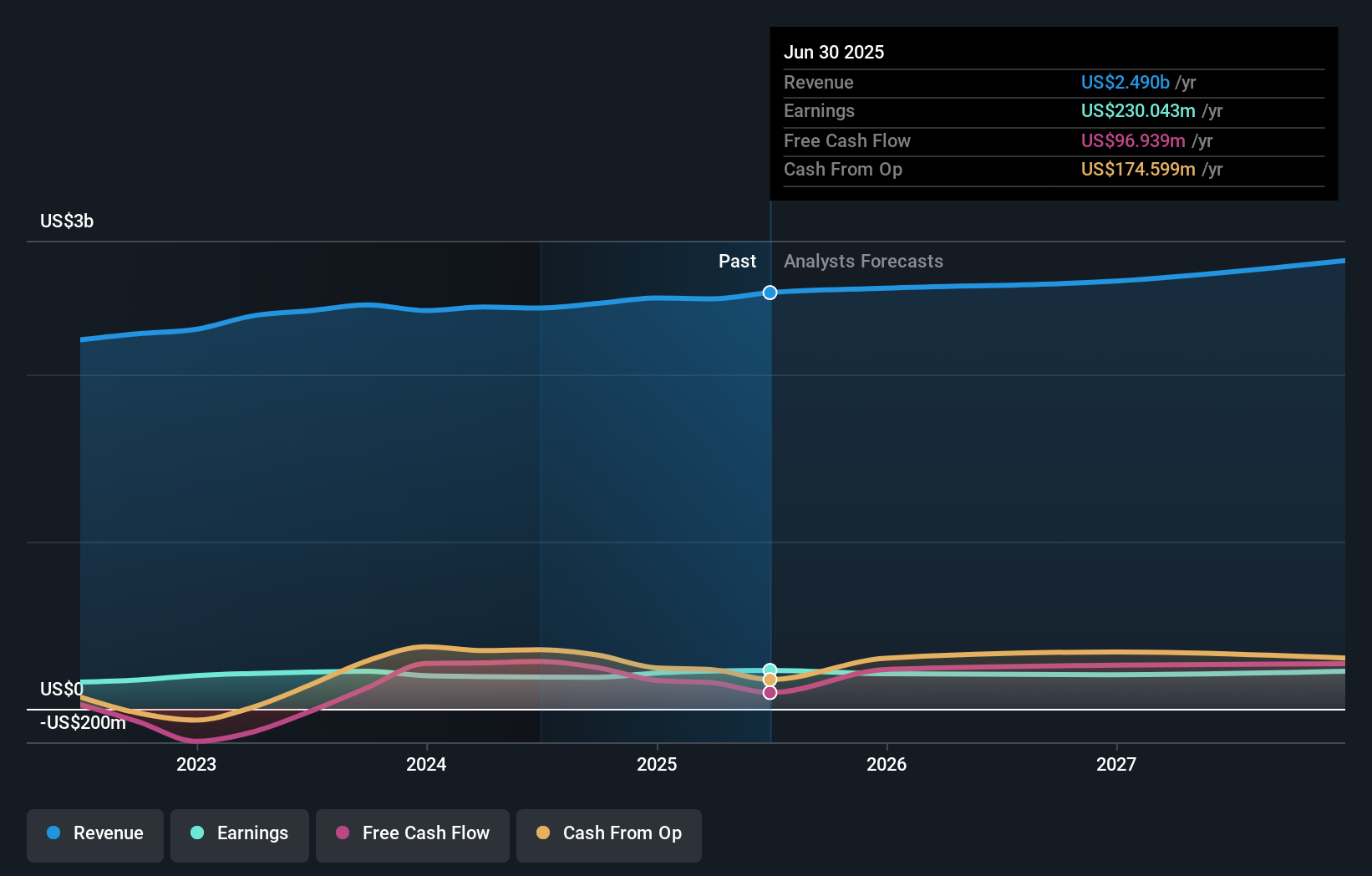

Acushnet Holdings is projected to reach $2.7 billion in revenue and $208.8 million in earnings by 2028. This outlook assumes a 2.5% annual revenue growth rate and reflects a decrease in earnings of $21.2 million from the current $230.0 million.

Uncover how Acushnet Holdings’ forecasts yield a $75.86 fair value, a 6% downside to its current price.

Exploring Other Perspectives GOLF Earnings & Revenue Growth as at Oct 2025

GOLF Earnings & Revenue Growth as at Oct 2025

Three fair value estimates from the Simply Wall St Community range from US$75.86 to US$98.73 per share. While these opinions span a wide gap, remember that expectations for continued high growth in global golf participation are fundamental for the company’s prospects, so contrasting viewpoints can help you recognize what drives optimism or caution.

Explore 3 other fair value estimates on Acushnet Holdings – why the stock might be worth as much as 22% more than the current price!

Build Your Own Acushnet Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com