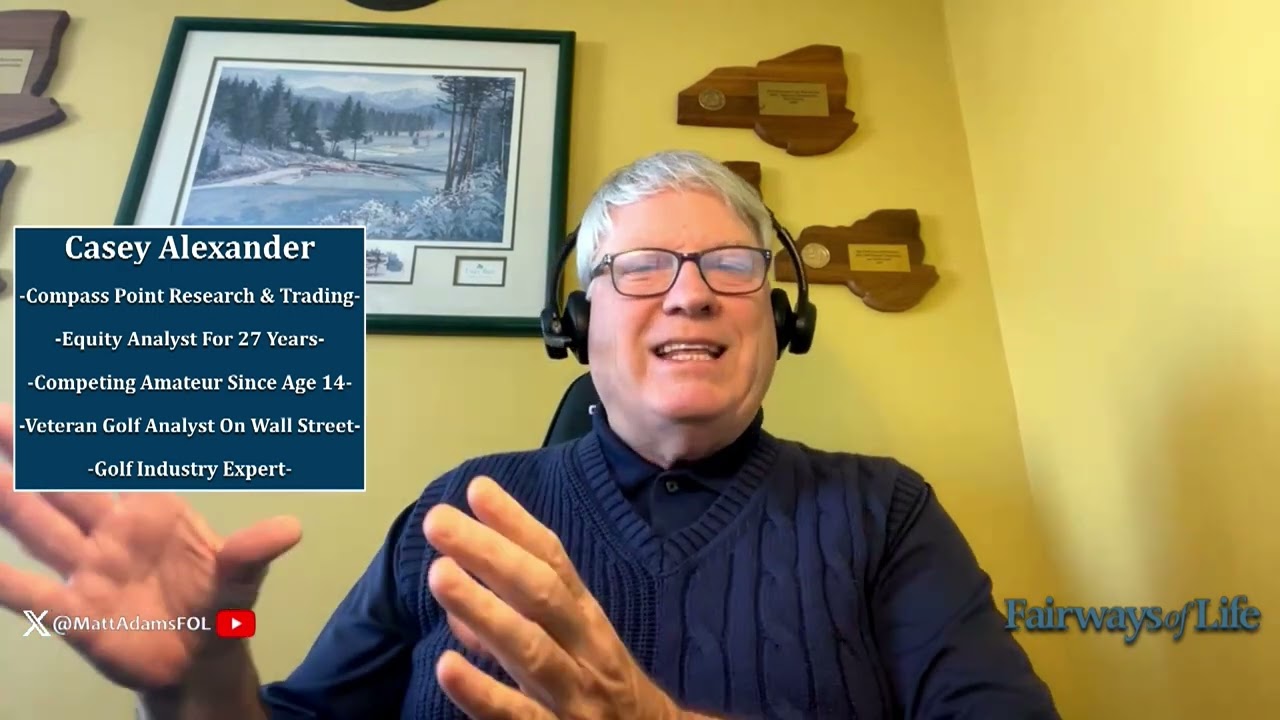

Fairways of Life is joined by Casey Alexander, Managing Director/Equity Analyst for Compass Point Research and Trading. Casey is a golf industry expert and has been an equity analyst for 27 years, as well as a competing amateur since age 14. He shares insight on the news of PGA Tour Enterprises, the new partnership between the PGA Tour and the Strategic Sports Group.

Our Guest is Casey Alexander managing director he’s an equity Analyst at compass point research and trading he has almost 30 years of experience as an equity analyst he’s the longest tenured golf analyst in fact on Wall Street obviously makes him an expert in the industry and he’s also a very highly

Competitive uh amateur golfer as well of renown so Casey first of all welcome to the program my question where I’d love to start today is the deal between the PGA Tour and the Strategic Sports Group how would you explain it how would you describe what it is and what does it

Mean well I think it it shows you how the nature of compensation for golfers which are almost inarguably Global Sports Superstars is changing you know you think about the nature of compensation in other sports football baseball basketball soccer 90% of that compensation is contractual compensation and only 10% of that compensation is

Performance-based compensation a lot of it is based upon performance that has already taken place but it’s contractual compensation at its heart and golf has traditionally been almost 100% performance-based compensation outside of perhaps Club endorsement contracts and when you think about it that’s not the way that Global Sports

Superstars are paid and not in this day and age and so the idea that a global Sports Superstar um can come to your event provide his name image and likeness uh participate in your pram spend two days promoting your event have a bad Friday afternoon and walk away with zero

Compensation that’s not the way that a Rory mroy or a John ROM is going to be compensated in a day and age where they are Global Sports Superstars so the deal with SSG is designed to provide an element of contractual compensation to PGA Tour players and to Global Superstars because

That’s what Liv and the piff have done with Liv is they’ve provided a higher element of contractual compensation uh while still maintaining an element of performance based compensation at each tournament’s event um and which the PGA Tour will do as well but let’s just not forget here that

We are transitioning to a period where there will be more contractual compensation for golf Global Sports Superstars and frankly that’s the way Global Sports Superstars are paid these days the the fact that you’ve used the phrase Global Golf Superstars multiple times Casey I’m curious if that’s an indication of the fact of whether

Whether we in the golf industry are not fully realizing just how Global these players are how big they are in terms of superstars on a global basis I know for example uh the the last research study I saw was that I believe golf was eighth globally eighth largest sport globally

Which put it in front of just as an example the NFL yeah I think it it’s a fair statement Matt um I I would bet you Donuts to dollars that if you went to Korea um you know royan maroy and John Ram are better known than Tom Brady and pton Manning in

Korea uh frankly this is a global game even more so played in over 100 countries around the world and and the other thing is is that this game feeds to a demographic that is highly attractive for advertisers and sponsors and and that’s why it may seem like it’s an outsized level of

Compensation relative to the number of eyeballs that it draws but the fact of the matter is the demographics of the eyeballs that it draws are highly attractive to um you you know advertisers and sponsors that want to head towards upper income uh uh you know democ Graphics all right so let me ask

You a question from a little bit of a different perspective then you’ve explained to us how and why this is likely going to evolve in some way shape or form to the benefit of players from a compensation level or otherwise but from the the position of those with the

Strategic Sports Group they are investing potentially billions of dollars what do they hope to get from that what is the ROI well that’s a great question normally and I’ve heard this characterized as a private Equity investment I think that only has to do with structure in this particular

Instance all right the folks that are behind SSG I I mean come on we’re talking about owner of the Mets owner of the Red Sox you know owner of major sports teams the typical private Equity time Horizon is 3 to five maybe seven years looking for a payback on your

Investment not these f folks these are not the typical private Equity investors these are folks that intend to hold on to this for a long time and and hopefully create generational wealth out of this investment in the PGA Tour that is similar to the point of view of piff I have

Found it interesting that it’s been characterized several times that that piff is spending money with no intent for any economic return that’s just a misunderstanding of time Horizons here okay the the the piff invests in terms of decades and generations not a 3 to fiveyear time Horizon similar to private

Equity and Investments for decades and generations can take a very long View and in this case a fund of this size can burn a billion or two here looking towards a return where 10 years 15 years 25 years from now it’s generating 1 to two to three billion per year in

Additional income for them as a part of their potential investment in the game and I would also point out that it’s extremely likely that there’s still going to be an investment from the piff fund because the level of compensation is still not even between the two parties involved here and until piff is

Involved in the PGA Tour which would provide them the motivation to level out the these these Avenues of income that have been created um that’s when you’re going to eventually be able to create a fully integrated Global Golf Tour and the great thing about it is it’ll have

Black hats it’ll have white hats it’ll have Hatfields and McCoys and what golf has always asked for year in and year out is great rivalries and the way that this is working out it is likely to create really interesting rivalries and television and the media will eventually grasp onto that because that’s what

Television and the media does it it it writes great stories and it and it knows how to do that all right so let’s talk about if you will at least the television half of television and media and and this idea of time Horizons in whatever time frame you please Casey I’m

Curious where this massive return is going to come from that’s going to give back the profit to the people that have made this investment and again in whatever time frame that takes is it anticipated in actually the global growth of the game so is it television

Revenue is it because the game when it gets bigger and unified it’s going to attract more corporate investment where where are the dollars coming in from well where are they coming in from today Matt we’re seeing the NFL move to streaming platforms such as Thursday night Prime we saw a playoff game that

That earned incredible rights fees just by going to Peacock okay how long is it going to be before you’re going to watch the British Open on peacock okay that sort of ability to push to every platform available is raising the revenue streams for virtually every sport globally the idea that golf isn’t

Eventually going to evolve in that direction and participate from it and those additional SC um streams of income are going to draw more sponsors I I think we could bet that at some point in time we’re going to see Wells Fargo back in the fold of the global Golf Scene uh

Because it’s a global financial institution so Casey when you see a Consortium like the Strategic Sports Group come together uh as investors but in essence now as owners of a major sports League what does that tell you about sport at large is this something that you expect to see

In just name some of the sports that that that these same entities are owners of the NBA the NHL the NFL Major League Baseball English Premier League maybe Formula 1 etc etc etc well I think I think to a certain extent in many of these other sports

Were already there uh the NFL is trying to push more globally Arthur Blank is a part of the sports Str strategic group baseball is starting to really become more of a global game we’ve seen the incredible signing of Shai Otani um and the other thing is is that these are

Folks who already work in their own businesses on a global scale and in many cases have worked many times with Sovereign wealth funds and so I think they’re going to find a path to work with piff perhaps easier than the PGA Tour without their involvement would

Have been able to and and I think you know you’ve seen that from statements from Rory that you know there’s a way that this goes forward and where does it eventually end up is where it should have ended up in the first place which is a fully integrated Global Golf Tour

That that intermixes all of these Global Sports Superstars which I I know no no other way to describe them because they are known known virtually globally you know I Casey I I know it’s somewhat a sign of the times kind of the red state blue State society that we live in but

There are parties that are trying to Define what’s going on right now to say somehow the investment from the Strategic Sports Group is wall building or fence building if you please uh in between the PGA Tour in the public investment fund what is it in reality does this investment by the Strategic

Sports Group help further the negotiations with piff Where Do We Stand oh I think very much so I think it does help it in the long term uh simply because these are folks again that in their own businesses in many ways have dealt with Sovereign wealth funds um

And you know they all do have some experience with private equity in their backgrounds and every one of them you know has learned that other people’s money is another way to make money um also uh as I mentioned before having the the piip fund involved in the PGA Tour

Structure gives the pit fund motivation to level out the compensation levels of Liv versus the PGA tour which will then allow for crosscurrents the way that it sits right now if you think about it Matt just think about the fact that there’s a higher level of compensation

Available on the live tour what does that do that encourages guys who have just want a major to then take a higher level of contractual compensation on the live tour knowing that their grandfathered into the majors for the next 5 years um and be able to generate

Lifetime wealth in a 5-year period of time uh through membership of the live tour until you even out the levels of compensation between the two tours and start to allow some crossover there’s always going to be some motivation for unfortunately the best players to step

Across to a a a a tour that gives them a higher level of contractual compensation compensation as opposed to performance-based compens fascinating stuff now Casey you you’ve basically answered this in way shape or form already today but I want to ask you straight up your job is to analyze

Businesses your job is to analyze Industries if you were looking at golf at its top tier of competition which is inclusive of Liv it’s inclusive of the PGA Tour it’s inclusive of the DP World Tour how would you grade that industry right now look I think it’s gone through a a

Period uh somewhat of upheaval I think if you’re a player no matter which tour you on you have to thank the involvement of the piff tour because it certainly raised your standard of compensation I understand why fans right now are saying I kind of have lost interest in watching

PGA Tour events I’m not super interested in watching live tour events but I think we’re going through this period of transition that will end up in a fully integrated Global Golf Tour and when it does like I said you’re going to have great storylines driven around the Hatfields and The McCoys The Spectator

Spectating golf public has been dying for rivalries for years and you’ve just built in a full generation of rivalries uh for spectators that can make for some of the most compelling TV ever and that will drive revenues through broadcast streaming alternative channels of distribution that will make both tours

And all tours more more popular in the end all right so Casey I would like you to hear the following comments from Patrick cantlay who is a member of the board and these were made immediately after the announcement was made so I can get your reaction here’s Patrick

Cantlay yeah I think um you know hopefully this strengthens up the PJ tour that’s the that’s the idea and I think it will uh the investors that we have coming alongside are very experienced and very sophisticated and um hopefully it’s uh uh a real positive step in the right direction I think it

Will be yeah I think anytime someone makes a sizable investment like that they’re going to be watching over the investment um and I think because of their Sports Experience we’ll really lean on their expertise to try to grow the sport and make it as good as it

Possibly can be well I think you’ve already seen some some changes by the tour over the last couple years sizable changes and so uh to together getting the top guys together more often which I think is good um you know this event uh you see has the strongest field that

It’s had in a number of years and I think that’s fantastic I think that’s what the fans want to see and so I really hope that um you know this this deal brings about change that really makes it better for the fans because I think they’ve suffered a lot over the

Last couple years and and I hope that it’ll the product will be better for them going forward you know everyone’s divided like I’ve said over the last couple years I’ve been pretty pretty the the same I mean people are welcome to make the choice that they’d like to make

It’s a personal choice it has been and um you know as far as coming back we’ll see it’s up to a group of us I know players feel all over the board on that issue um and so my job as a player directors is to represent the entire

Membership and so if something like that were to come down the road I’m sure sure we would have to have a robust conversation around that topic I think the PJ tour is definitely uh Stronger after having this deal uh go through um as far as piff I haven’t been having any

You know real conversations myself about that so I think you know that’s a question for down the road uh for the board and for also the the newco board to decide all right so Casey it sounds like Patrick Klay is echoing the same enthusiasm for the future that you are

Telling us that we can look forward to with his investment is there anything else in what he said that struck you uh well I didn’t hear anything that he said that was in conflict with anything that I’ve laid out today um other then you know the road back to

Getting the two parties to the point where they can play together on a fully integrated Global Golf Tour because he’s right the PGA Tour is trying to create cretive format with their elevated events where the best players can can be together to play against each other but

Let’s not kid ourselves it’s not all the best players and and and certainly there there’s a group of players on the live tour that that clearly and adequately belong in that category should be uh in that sentence and eventually the needs of the media to create great golf stores

Will require them to be together more than just the four majors each year do you think Casey that this is a situation where the tide is going to make all the ships rise what about mid-tier golfers regardless of the tour that they play on currently yeah I think that’s tough I I

Do think that that the structure of the PGA tour with the elevated events is sort of bifurcating the tour a little bit um I also do have question questions relative to how they’re going to distribute ownership shares to PGA Tour members of this new entity and one would

Assume that there’s going to have to be some sort of vesting process right you wouldn’t want an owner to be somebody who you know misses 17 Cuts this year and is outside the top 125 um and yet has a Perpetual ownership stake in the tour it’s got a vest over

Some period of time uh uh relative to each individual’s performance and and that’s what those guys at SSG are likely going to be very good at figuring out the most Equitable way to do that um but ultimately I think that that that they’re going to be welcoming to put

Both sides together to create something even better fascinating stuff Casey I and I appreciate your perspective that you have provided to us today both in its breadth and width and also with your cander of the same as I was saying earlier in the program I happen to

Completely agree with you I think this investment from the Strategic Sports Group makes the game stronger not just the PGA Tour it makes the game stronger as they move forward with further discussions with piff and what this means for the future of the game and where golf sits I am interested in

Something else though so since I have you here I want to I want to tap into your expertise I saw a recent report that you were one of if not the prime AR author of which was talking about the game of golf in 2024 now I’m talking

About all of you at home and how the game of golf is going to impact you rounds played equipment purchases etc etc right could you talk to us about 2024 and how it looks for the game of golf sure uh you know it’s my expectation that that at least as the

United States is concerned that 2024 is likely to be a record year for golf club equipment sales and I you know and look my job isn’t to tell you what the future is my job is to tell you what the odds are okay and we try to help investors

Stack the odds in their favor and but we’ve got a number of signposts that lead us to that 20123 had a record number of rounds played over 520 million rounds it had a record number of participants uh uh 26.6 million participants which which fin exceeded the previous record that I

Think goes back more than 10 years um previously uh and those surveyed which which were over thousand surveyed by Sports and Leisure research group um have a record intention to play more rounds in 2024 and have their highest expectation ever to spend the same or more uh uh for

Equipment in 2024 so you connect those dots which is record rounds played by record participants who have a record intention to play as much or more and a record intention to spend as much or more and that should lead you to the conclusion that 2024 will be a record

Year for equipment sales because intention is way more important than what their actual ability to play is follow track and that should lead to record equipment sales in 2024 at least as the United States goes and since that’s 50% of the market for Global Golf

Equipment sort of as the US goes so so kind of goes the rest of the world at least in the general sense that is fascinating Casey but I’m curious about one thing you know from call it a romantic perspective with the game if you will we look at it and say you know

During Co and postco people discover the exercise Virtues Of The Game the fact that you can reconnect with other human beings through the games obviously the fun and the challenge uh challenging aspects of the game Etc but from your perspective from the perspective of cold numbers why is the game of golf

Continuing to flourish well it’s not cold numbers Matt okay what happened here is the prior to Co you know the the the the statistics were that two out of every three people who joined the game quit inside of a year okay and for all the reasons that

We know it’s a it’s a supremely difficult game to learn it’s very difficult to get over the hump of proficiency it has a Byzantine set of rules and in often cases golf isn’t particularly friendly to newcomers it can be somewhat of a hostile environment uh uh again with a with you know

Something outside the rules called etiquette which makes things complicated for new folks joining the game but the fact of the matter is is that Co had a 2-year cycle of other forms of entertainment that was not available to those folks and golf was Outdoors it was

Social it was available and it was a safe way for women kids Etc to socialize and have fun and get exercise uh without risking themselves in the co environment what it did was 2 years forced many of those to get over the hump of proficiency and get to the point where

They went from newbies to actual golfers and once you become an actual golfer the the avidity of the game is compelling and as you know once you’re over that hump of proficiency and consider yourself a golfer not a startup golfer that then then you’re hooked then you’re there in whatever form that you

Were hooked to which we welcome all of those forms in the game of golf Casey Alexander is a managing director at Equity analysts at compass point research and trading uh compasso llc.com is the website thank you for your time my friend fascinating as always Matt thanks so much for having me

On especially on one of your first shows and congratulations on your show joining the Golf Channel I appreciate that my friend we’ll be back with more of the fairways of Life show right after this

1 Comment

Nice get with this analyst. Matt is the Mike Florio of golf – sees and presents the big picture. If he keeps it up, he will get the biggest interviews in sports and subscriptions will deservedly skyrocket.