LBLV provides an overview of economic news.

Website LBLV is available at –

The main economic news for Monday, April 20:

1. U.S. crude at the lowest amid fears of oversupply

Crude oil futures fell on Monday, with U.S. futures dropping more than 10% to levels unseen since 1999 amid fears that storage facilities in the United States will soon be overcrowded and lead the global demand to the lowest level. The volume of oil held in U.S. storage, especially at Cushing, the delivery point for the U.S. West Texas Intermediate (WTI) contract, is rising as refiners slow activity due to slumping demand. Michael McCarthy, chief market strategist at CMC Markets in Sydney, said “it hasn’t reach capacity, but the fear is that it will.” At least a record 160 million barrels is estimated in floating storage in tankers now. The May WTI futures declined $3.40, or 18.6%, to $14.87 a barrel. At one point, the contracts had fallen as much as 21% to a minimum of $14.47 a barrel – the lowest since March 1999. Meantime, Brent crude futures were also lower, lost 90 cents, or 3.2%, to $27.18 a barrel.

2. South Korea cautiously reopens its economy

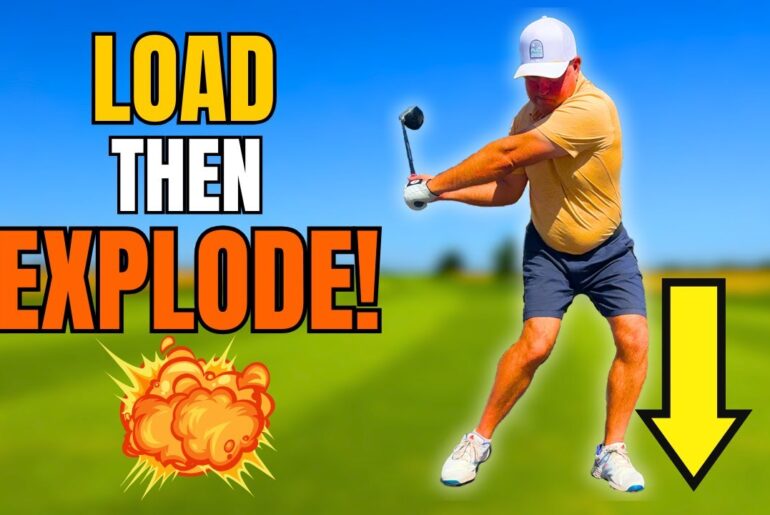

South Koreans are returning to work and crowding shopping malls, parks, golf courses and some restaurants as the country relaxes social distancing rules amid a continued downward trend in coronavirus cases. A growing list of companies, including SK Innovation and Naver, has ended or eased their work from home policy in recent weeks, though many continue to apply flexible working hours and limit travel and face-to-face meetings. Parks, mountains and golf courses brimmed with visitors over the weekend, while shopping malls and restaurants were slowly returning to normal. Meanwhile, South Korea extended its social distancing policy for another 16 days on Sunday, but offered some relief for religious and sports facilities previously subjected to strict restrictions. Overall, the decision is aimed at cautiously reopening Asia’s fourth-largest economy as daily infections continue to hover around or less than 20, most arriving from overseas.

3. Shake Shack returns aid loan as it raised funds

U.S. burger chain Shake Shack Inc will return the small business loan it received from the government, the company’s chief executive said on Monday. This firm became the first one to hand back money aimed at helping small businesses ride out the coronavirus impact. CEO Randy Garutti and founder Danny Meyer said the company will immediately return the entire $10 million SBA loan as it was able to raise additional capital. Last week, the food firm raised about $150 million in an equity offering. SBA, which is a key part of the government’s $2.2 trillion aid package, is aimed at helping small companies keep paying their employees and their basic bills during the shutdowns. Shake Shack said the money it received could be reallocated to the independent restaurants “who need it most, (and) haven’t gotten any assistance.”

4. Alibaba allocates funds for cloud infrastructure

Alibaba Group Holding Ltd said it will invest 200 billion yuan ($28 billion) in its cloud infrastructure over three years. This move was following a boom in demand for business software amid the coronavirus outbreak in China. The tech giant said in a statement it will spend the funds on semiconductor and operating system development as well as building out its data center infrastructure. While most of China’s office employees were working from home throughout February, the company saw usage surge for its software, most notably DingTalk, a workplace chat app used by both businesses and schools. Alibaba’s cloud division is one of its fastest growing businesses. Fourth-quarter revenue climbed 62% to 10.7 billion yuan, topping 10 billion yuan in a single quarter for the first time.