Acushnet Holdings Corp., the parent of the Titleist, FootJoy and KJUS brands, appears to be basking in a world far different from other brands and retailers in the current economic environment. Conversations and reporting continue about a “K-shaped” economy – with those in the upper tier of income showing continued growth and comfort with the current economy, while those in the lower rungs of household income increasingly experience living month-to-month or even week-to-week to keep their families fed and housed.

The Business of Golf is not just a status symbol as it once was – it may be a reflection of what is working in the overall economy. Stories are written daily these days about how the travel business appears to be insulated from the downturn many are feeling. The same holds true for higher-end home purchases and luxury items. Golf is apparently in this mix – at least Acushnet – with those that can afford a new set of clubs on a regular basis and a country club membership appearing to be far less affected by the underlying issues of the current U.S. economy.

During a conference call with analysts on November 5, Acushnet Holdings Corp. President and CEO David Maher summarized his take on the Business of Golf – at least for those brands that aren’t in a race to the bottom.

“As the golf world exits peak season in many regions and begins prime time across the Sunbelt [region], the sport and business of golf continue to be vibrant, with an increased number of golfers playing an increased number of rounds globally,” Maher noted. “After a weather-induced slow start to the year in the U.S., rounds of play accelerated in the third quarter, which is the largest participation period of the year, and we now expect worldwide rounds in 2025 to match or exceed what was a record in 2024.”

He added, “Acushnet’s trade partners are, by and large, healthy and investing to enhance their facilities and ultimately their value propositions to best meet the evolving preferences of tomorrow’s golfers.”

Maher said the global golf market is “structurally sound,” with momentum in the U.S. and EMEA offsetting softness – mainly from footwear and apparel – across Japan and Korea.

“Within Acushnet, our team is relentlessly focused on exceeding dedicated golfer expectations, developing great products, earning the trust and endorsement of the pyramid of influence and our partners, and executing a wide range of fitting and golfer connection initiatives,” the CEO continued. “Tying this together is the company’s unwavering commitment to product quality, best exemplified by every Pro V1 golf ball, which passes more than 100 quality checks throughout the production process.”

The result? The Pro V1 golf ball return rate is one golf ball out of every 16 million Pro V1s produced.

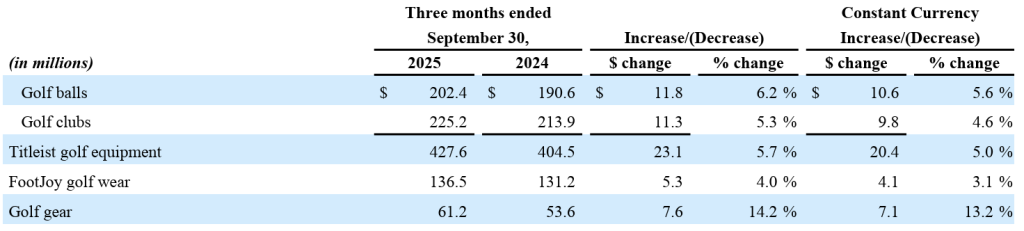

Third Quarter Summary

Consolidated net sales for the third quarter increased 6.0 percent, or 5.3 percent on a constant-currency (cc) basis, to $397.0 million, which was said to be largely driven by higher net sales in Titleist golf equipment, primarily due to higher average selling prices in golf clubs and sales volumes in golf balls, and higher net sales in Golf gear and FootJoy golf wear, reportedly driven by higher average selling prices across all product categories in both segments.

“All reportable segments posted gains during the quarter, led by Titleist golf equipment with healthy demand for Titleist golf balls and the successful launch of our new T-Series irons,” shared Maher. “Acushnet’s focus on product innovation, quality and fitting services are resonating with golfers and contributing to the overall health of our Titleist, FootJoy and KJUS brands.”

Maher said the key drivers of the business growth have been the year-to-date growth of the Pro V1 franchise in all regions and the very successful launch of new Titleist T-Series irons and limited edition Vokey SM10 wedges in the third quarter.

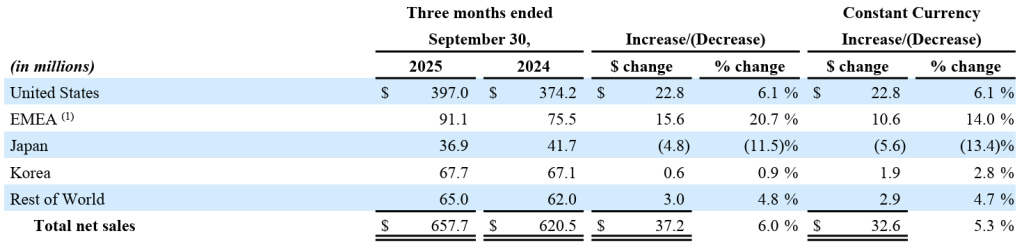

Third Quarter Sales by Region

Titleist Golf Equipment posted a 5.7 percent increase in net sales (+5.0 percent cc) to $427.6 million, said to be primarily driven by higher average selling prices (ASPs) across all golf club product categories and sales volumes of 2025 Pro V1 golf ball models. In addition, higher sales volumes of the recently launched T-Series irons and second model year SM10 wedges were reportedly more than offset by lower sales volumes of second model year drivers and fairways.

“We have spoken in recent years about the investments we have made to strengthen our golf equipment product development and enhance manufacturing capabilities,” he continued. “Our growth and momentum today are byproducts of these investments.

The Golf Gear segment also had a strong quarter, posting a 14.2 percent (+13.2 percent cc) increase in net sales to $61.2 million. Maher said the segment was up 8 percent year-to-date as the team “brings a steady flow of compelling products to market and leverages our expanding custom capabilities and strengthening supply chain.” The segment growth was said to be primarily driven by higher ASPs across all product categories and higher sales volumes in golf gloves.

Within Golf Gear, the company’s travel brands reportedly increased 20 percent year-to-date, with especially strong growth from the Links & Kings and Club Glove brands, Maher shared.

The FootJoy Golf Wear business reportedly continues to build momentum and delivered another positive quarter with revenues 4.0 percent (+3.1 percent cc), said to be largely due to higher ASPs across all product categories and higher sales volumes in apparel, partially offset by lower sales volumes in footwear.

“FootJoy is benefiting from the success of our Premier and Hyper-Flex footwear models, fewer footwear closeouts, and steady glove growth,” the CEO noted. “FJ’s apparel business adds to the brand story, showing resilience with quarterly and year-to-date gains. As we have discussed throughout the year, these trends are positively affecting FJ’s market momentum and financial performance in 2025.”

Maher said net sales of products not allocated to a reportable segment were “up nicely” in the quarter, with continued momentum and double-digit growth from shoes, led by outsized gains across the golf business.

Third Quarter Sales by Region

Maher said the U.S. market continues to be strong, with sales up 6 percent with growth across all segments led by Titleist golf equipment. U.S. sales growth was reportedly were largely driven by increases in Titleist Golf Equipment of $13.4 million, Golf Gear of $4.8 million and FootJoy Golf Wear of $2.4 million.

The increase in Titleist golf equipment was said to be primarily driven by higher average selling prices in golf clubs, as well as higher sales volumes of our 2025 Pro V1 golf ball models.

Higher sales volumes of the newly introduced T-Series irons and second model year SM10 wedges were reportedly more than offset by lower sales volumes of second model year drivers and fairways.

The increase in Golf gear was primarily driven by higher average selling prices across all product categories. The increase in FootJoy golf wear was primarily due to higher average selling prices in golf gloves and apparel.

An increase in net sales of products that are not allocated to one of the company’s three reportable segments also contributed to the change in net sales.

Net sales outside the United States increased 5.8 percent (+4.0 percent cc), driven by increases in EMEA, Rest of World and Korea, partially offset by decreases in Japan.

The EMEA region was up 14 percent in the quarter and was up 8 percent year-to-date. Maher said rounds of play are up high-single digits as the region benefited from favorable weather comps versus last year.

Korea was up 3 percent in the quarter with strength in Titleist Golf Equipment, led by golf balls

Rest of World sales increased 5 percent in the quarter and 3 percent year-to-date, said to be primarily driven by higher net sales across all reportable segments.

In Japan, the 13 percent decrease in the quarter was said to be primarily due to lower net sales in all reportable segments, as well as products that are not allocated to one of the three reportable segments.

“In summary, we are pleased with Acushnet’s performance in the quarter and the overall health of our consumer,” said Maher. “The company’s product lines are in great shape. Inventory positions, both owned and at retail, are in line for this time of the year, and we are confident in our team’s ability to execute against our strategies.”

Profitability and Expenses

Gross profit in the third quarter amounted to $319 million, up $15 million compared to 2024, reportedly driven by increases across all three reportable segments, primarily related to higher average selling prices, higher sales volumes, and a favorable mix shift in FootJoy. Company CFO Sean Sullivan said the company also had approximately $10 million in incremental tariff costs in the quarter, and recognized $15 million for the year-to-date period.

Gross margin was 48.5 percent in Q3, down 50 basis points y/y, primarily related to the headwind from higher tariff costs.

SG&A expense was $205 million in the quarter increased $5 million from the third quarter of 2024 as the company continues to invest in A&P to support new product launches and future growth initiatives, including a fitting network and IT systems. SG&A also included $2 million of restructuring costs related to the voluntary retirement program the company initiated earlier this year.

“As a reminder, we expect a further charge in Q4 related to this program of approximately $5 million,” offered Sullivan.

Interest expense of $14.5 million in the quarter was up $1 million due to an increase in borrowings.

The effective tax rate in Q3 was 37.3 percent, up from 19.3 percent versus last year, primarily driven by a shift in a jurisdictional mix of earnings and a reduced income tax benefit related to the U.S. deduction of foreign-derived intangible income resulting from the enactment of the One Big Beautiful Bill Act.

Net income attributable to Acushnet Holdings Corp. decreased 13.7 percent y/y to $48.5 million, said to be primarily as a result of an increase in income tax expense, offset in part by an increase in income from operations.

Adjusted EBITDA was $118.6 million, up 10.4 percent y/y. Adjusted EBITDA margin was 18.0 percent for the third quarter versus 17.3 percent for the prior-year Q3 period.

Balance Sheet and Cash Flow Summary

On the quarterly conference call, Sullivan said the strong balance sheet and consistent cash flow generation continue to support the disciplined execution of our capital allocation strategy.

Year-to-date cash flow from operations decreased from 2024, primarily due to increased investments in strategic initiatives, including IT systems and increased working capital requirements.

Capital expenditures (CapEx) were $51 million in the first nine months of 2025, and the company now expects full-year CapEx spend to be approximately $75 million.

Net leverage ratio at the end of Q3, using average trailing net debt, was 2X.

Inventories were up 3 percent when compared to last year’s third quarter, reflecting some advancement of inventory ahead of tariff deadlines and the impact of the 2025 irons launch.

“We remain focused on investing in the business to drive long-term growth while also returning capital to shareholders through dividends and share repurchases,” Sullivan noted.

Cash Dividend and Share Repurchase

Through September, Acushnet returned approximately $230 million to shareholders, with $188 million in share repurchases and $42 million in cash dividends.

Acushnet’s Board of Directors has declared a quarterly cash dividend of $0.235 per share of common stock. The dividend will be payable on December 19, 2025 to shareholders of record on December 5, 2025. The number of shares outstanding as of October 30, 2025 was 58,661,329.

During the nine months ended September 30, 2025, the company repurchased 2,842,719 shares of its common stock at an average price of $65.96 for an aggregate of $187.5 million. Included in this amount, were 953,406 shares of common stock repurchased during the third quarter from Magnus Holdings Co., Ltd., a wholly owned subsidiary of Misto Holdings Corp., the Korean-based parent of the Fila brand, for an aggregate of $62.5 million in satisfaction of the company’s previously disclosed obligations under a share repurchase agreement with Magnus.

2025 Outlook

The company updated its full-year 2025 consolidated net sales guidance range to a range of approximately $2.52 billion to $2.54 billion on a reported basis. Consolidated net sales are expected to increase 2.6 percent to 3.4 percent y/y on a constant-currency basis. This range midpoint implies fourth quarter revenue of approximately $448 million, representing high single-digit growth over Q4 2023, a period consistent with the cadence of the company’s product launch cycle.

Acushnet is still forecasting low single-digit growth in the second half, driven by contributions across all reportable segments.

“We now anticipate the full-year FX impact to be negligible compared to last year, resulting in aligned reported and constant currency growth ranges,” Sullivan noted.

The company now expects full-year 2025 Adjusted EBITDA to be in the range of approximately $405 million to $415 million..

Sullivan shared that incremental full-year gross tariff costs are expected to be $30 million, about $5 million lower than the company’s previous estimate, driven by timing shifts and tariff-related variables. He said this reflects a $15 million gross tariff headwind in the fourth quarter.

“Through the strategic mitigation efforts we’ve discussed, we still anticipate offsetting a meaningful portion of the full-year gross tariff headwind,” Sullivan explained. “Overall, we are very pleased with our year-to-date performance and full-year outlook. The team remains focused on finishing the year strong and continuing to execute on our long-term strategic priorities. With that, I’ll now turn the call over to Sondra for Q&A.

Image courtesy Titleist/Acushnet Holdings Corp.