Acushnet Holdings Corp. recently announced third-quarter 2025 earnings, reporting sales of US$657.66 million, up from US$620.5 million last year, while net income decreased to US$48.51 million from US$56.22 million over the same period. An insightful detail is that despite the quarterly profit dip, the company achieved higher nine-month sales and net income compared to the prior year, highlighting year-to-date operational resilience. We’ll explore how Acushnet’s higher year-to-date sales, amid a quarterly profit decline, could influence its long-term investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Acushnet Holdings Investment Narrative Recap

Acushnet Holdings appeals to investors who believe in long-term growth in global golf participation, underpinned by premium products and operational strength. The most recent third-quarter results, which showed higher sales but a dip in net income, do not materially alter the near-term focus on maintaining pricing power through ongoing innovation, while the primary risk remains whether consumer demand can keep up with market expectations given the company’s valuation.

One recent announcement relevant to the latest earnings is the steady increase in quarterly dividend payments, signaling management’s continued confidence in cash flow and commitment to shareholder returns despite variability in quarterly profits. Dividend stability could play a meaningful role in reinforcing investor confidence during periods of short-term earnings pressure.

Yet, it’s worth paying close attention to the possibility that if golf participation growth slows…

Read the full narrative on Acushnet Holdings (it’s free!)

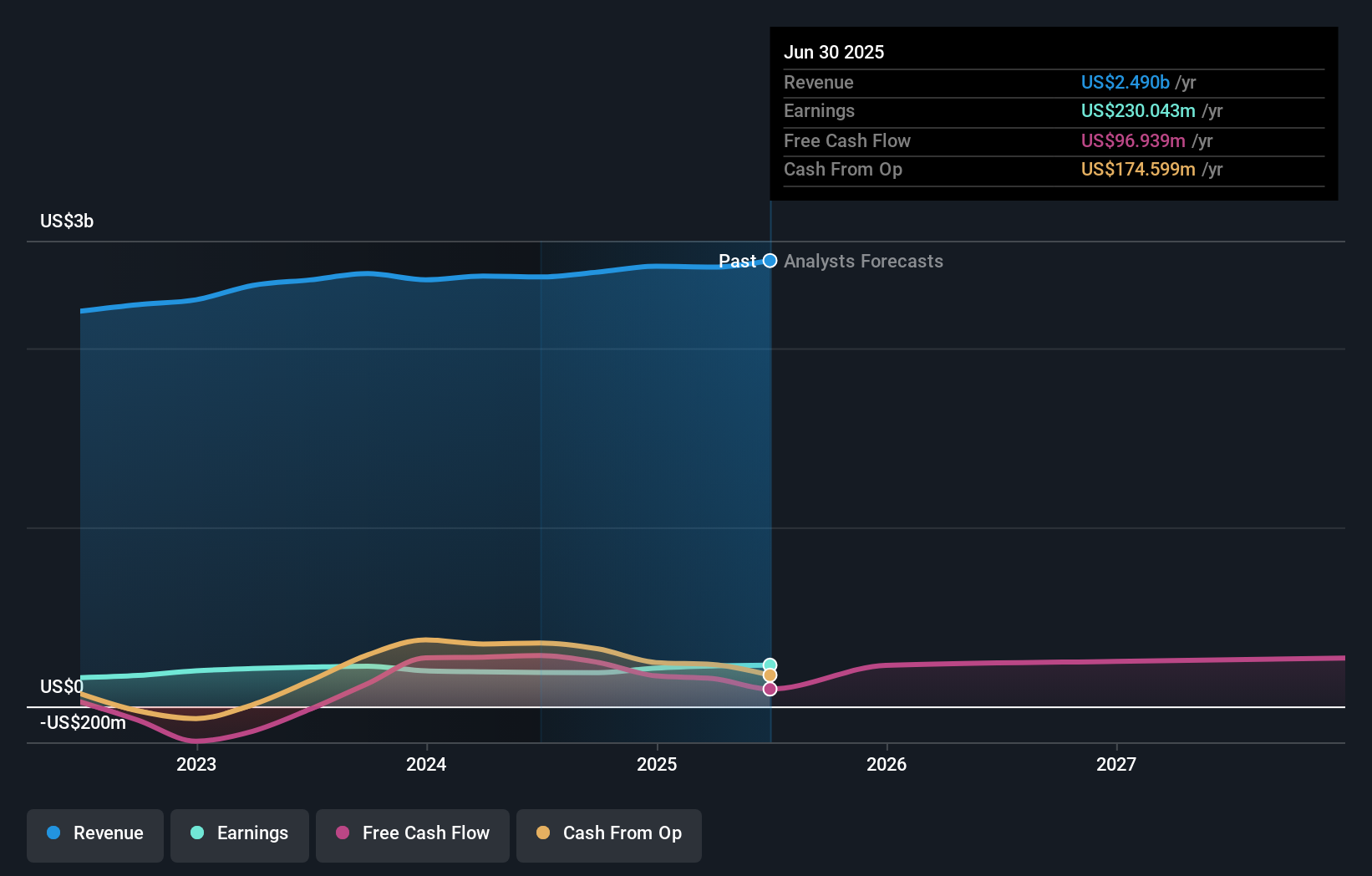

Acushnet Holdings’ outlook anticipates $2.7 billion in revenue and $208.8 million in earnings by 2028. This reflects an annual revenue growth rate of 2.5% and a decrease in earnings of $21.2 million from the current $230.0 million.

Uncover how Acushnet Holdings’ forecasts yield a $77.86 fair value, in line with its current price.

Exploring Other Perspectives GOLF Earnings & Revenue Growth as at Nov 2025

GOLF Earnings & Revenue Growth as at Nov 2025

Three community fair value estimates for Acushnet range from US$77.86 to US$112.06, offering a wide spread of investor opinions. In light of growth assumptions for golf participation, consider how these views may shift as the market absorbs new results.

Explore 3 other fair value estimates on Acushnet Holdings – why the stock might be worth just $77.86!

Build Your Own Acushnet Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com