Earlier this month, Acushnet Holdings reported a 5.4% year-on-year revenue increase and exceeded analysts’ EBITDA expectations, delivering stronger-than-expected quarterly results while its main peers posted mixed or weak outcomes. This performance not only spotlights Acushnet’s operational momentum but also distinguishes it within the leisure products sector, where competitors did not meet market forecasts. With Acushnet’s solid revenue growth outpacing analyst projections, we’ll explore how this shapes the company’s investment narrative and outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Acushnet Holdings Investment Narrative Recap

To be a shareholder in Acushnet Holdings, you need to believe that the global growth in golf participation and ongoing product innovation will support long-term demand, even as overall revenue and earnings growth are forecast to slow. The latest quarterly results delivered a revenue increase and EBITDA beat, but these positive surprises do not appear to materially alter the main short-term catalyst: continued consumer adoption of premium golf products. The biggest risk remains margin pressure from tariffs and inflation, which could dampen profitability if costs persist.

Of recent company announcements, Acushnet’s steady share repurchase activity stands out, as the company bought back 1,348,369 shares for US$88.37 million last quarter. This ongoing commitment to returning capital to shareholders is relevant context for any discussion about catalysts such as strong brand loyalty and premium positioning, which can underpin both market share and price premium, critical levers for the stock’s short-term and long-term appeal.

By contrast, investors should be especially aware of potential margin headwinds from tariffs and inflation, as…

Read the full narrative on Acushnet Holdings (it’s free!)

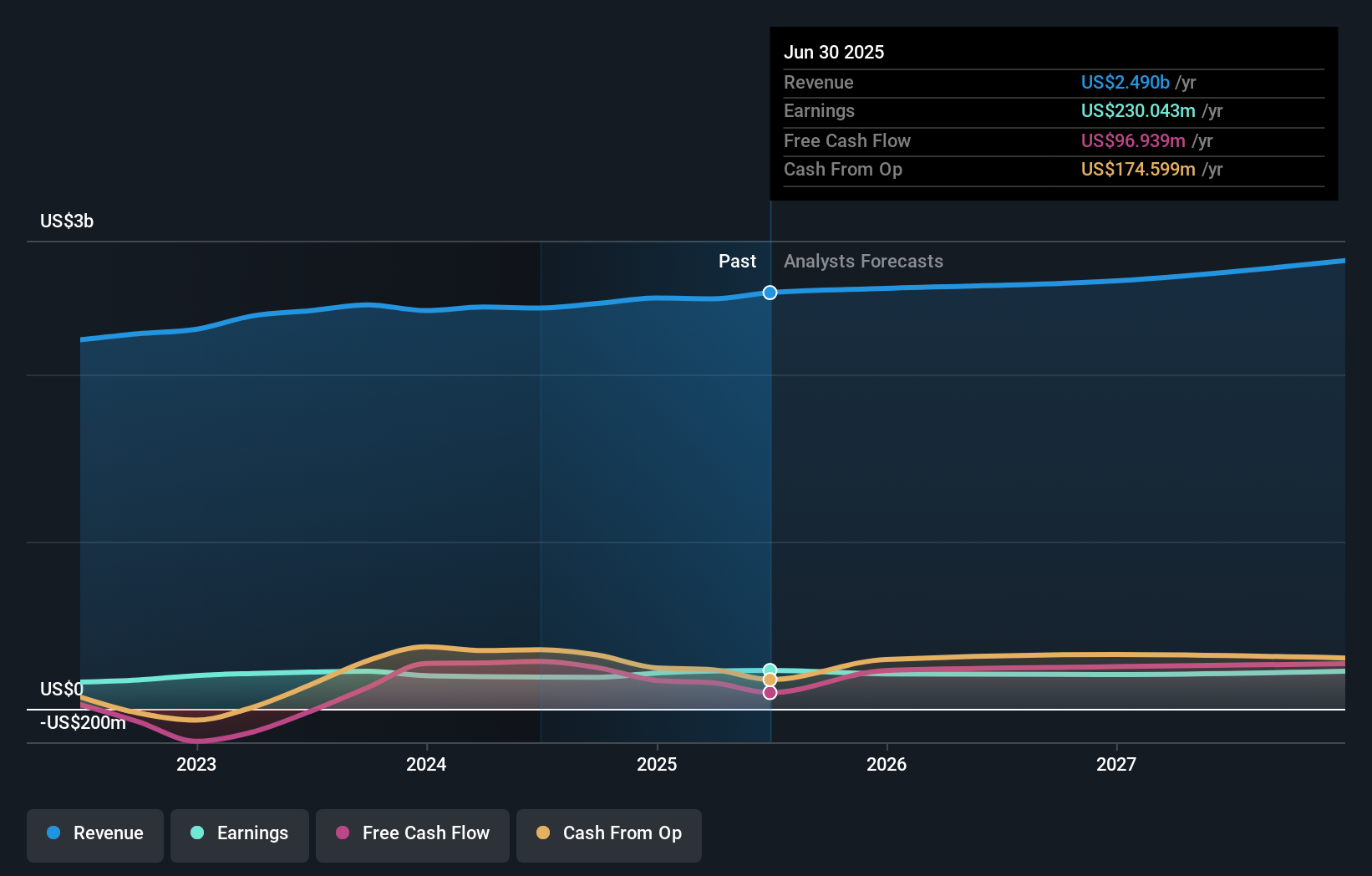

Acushnet Holdings is projected to reach $2.7 billion in revenue and $208.8 million in earnings by 2028. This outlook requires 2.5% annual revenue growth, but earnings are forecast to decrease by $21.2 million from the current $230.0 million.

Uncover how Acushnet Holdings’ forecasts yield a $75.86 fair value, a 7% downside to its current price.

Exploring Other Perspectives GOLF Earnings & Revenue Growth as at Oct 2025

GOLF Earnings & Revenue Growth as at Oct 2025

Three Simply Wall St Community fair value estimates range from US$75.86 to US$103.98, highlighting diverging views. Against this backdrop, current margin pressures remain a focal point for your assessment of Acushnet’s performance and outlook.

Explore 3 other fair value estimates on Acushnet Holdings – why the stock might be worth 7% less than the current price!

Build Your Own Acushnet Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com