Acushnet Holdings Corp., the parent of the Titleist and FootJoy golf brands, expects sales to slow slightly in the second half and to absorb a tariff hit of about $15 million. However, David Maher, Acushnet’s president and CEO, told analysts he remained encouraged by continued strong interest in the sport of golf.

“The sport and business of golf continue to be vibrant and healthy,” Maher told analysts. “Per the National Golf Foundation’s read on the U.S. market, 1.5 million new golfers entered the sport in 2024, marking the seventh consecutive year-over-year increase. These gains contributed to resilient participation results with worldwide rounds of play in the first half projected to be up 2 percent despite some of the weather related volatility we have experienced in The U.S. Acushnet continues to benefit from our focus on the game’s dedicated golfer whose healthy demographic and deep commitment to the sport helped to offset some of the macro uncertainties consumers are facing.”

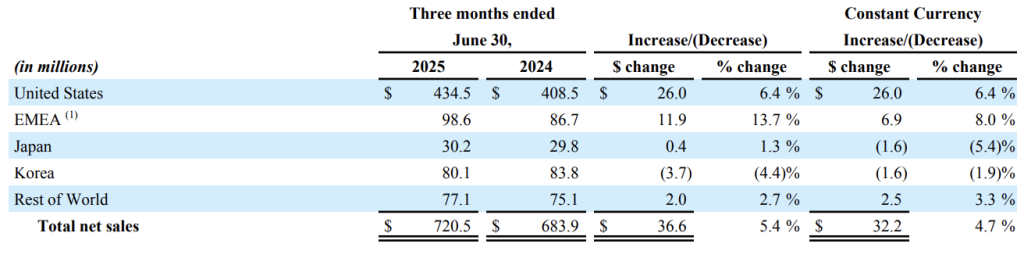

In the second quarter ended June 30, earnings increased 5.4 percent to $720.5 million, falling short of analysts’ consensus target of $713.47 million.

Net income grew 5.9 percent $75.6 million, or $1.25 a share, also below analysts’ consensus target of $1.33. The improvement reflected an increase in income from operations and lower income tax expense.

Adjusted EBITDA was $143.1 million, up 9.2 percent year over year. Adjusted EBITDA margin was 19.9 percent for the second quarter versus 19.2 percent for the prior year period.

Region Summary

On a geographic basis, higher net sales in the United States were largely driven by increases in Titleist golf equipment of $20.7 million and Golf gear of $4.8 million, partially offset by a decrease in FootJoy golf wear of $1.6 million. The increase in Titleist golf equipment was primarily driven by higher sales volumes of our GT drivers, fairways and hybrids and higher average selling prices across all golf club product categories, as well as higher sales volumes of our 2025 Pro V1 golf ball models. These increases were partially offset by lower sales volumes of our second model year irons and Phantom putters. The increase in Golf gear was primarily driven by higher sales volumes in golf bags and golf gloves. The decrease in FootJoy golf wear was primarily due to lower sales volumes in footwear, partially offset by higher average selling prices in footwear and golf gloves.

Maher told analysts the ongoing strength from its U.S. business came despite rounds of play being down slightly due to unfavorable weather.

Net sales in regions outside the United States increased 3.8 percent, or 2.3 percent on a constant currency basis, driven by increases in EMEA and Rest of World, partially offset by decreases in Korea and Japan. In EMEA, the increase was primarily driven by higher net sales in Titleist golf equipment, largely due to golf balls, and higher net sales in Golf gear.

Maher said EMEA’s growth of 6 percent in the first half reflects gains in Titleist golf equipment, primarily golf balls, as well as golf gear. He added, “The region is benefiting from outsized growth in he UK, where rounds of play are up 20 percent through June.”

In Rest of World, the increase was primarily driven by higher net sales in Titleist golf equipment. In Korea, the decrease was primarily due to lower net sales in Golf gear and FootJoy golf wear, partially offset by higher net sales of products that are not allocated to one of our three reportable segments. In Japan, the decrease was primarily due to lower net sales in FootJoy golf wear.

Maher said that while equipment growth remains healthy in both Japan and Korea, apparel, footwear and gear have been relatively soft. He said, “We expect our business in these regions to stabilize in the back half of the year.”

Segment Summary

Segment specifics

6.8 percent increase in net sales (6.1 percent on a constant currency basis) of Titleist golf equipment primarily driven by higher average selling prices across all golf club product categories and higher sales volumes of our 2025 Pro V1 golf ball models. In addition, higher sales volumes of our latest generation GT drivers, fairways and hybrids were more than offset by lower sales volumes of our second model year irons, Phantom putters and wedges.

1.3 percent decrease in net sales (2.0 percent on a constant currency basis) of FootJoy golf wear primarily due to lower sales volumes in footwear, partially offset by higher average selling prices across all product categories.

7.9 percent increase in net sales (7.2 percent on a constant currency basis) of Golf gear primarily driven by higher sales volumes in golf bags and golf gloves and higher average selling prices across all product categories.

Summary of First Six Months 2025 Financial Results

Consolidated net sales for the first six months increased 2.3 percent, or 2.9 percent on a constant currency basis, primarily driven by higher net sales in Titleist golf equipment, primarily due to higher average selling prices in golf clubs and higher sales volumes in golf balls, as well as higher net sales in Golf gear. These increases were partially offset by lower net sales in FootJoy golf wear in footwear and apparel categories. An increase in net sales of products that are not allocated to one of our three reportable segments also contributed to the change in net sales.

On a geographic basis, higher net sales in the United States were largely driven by increases in Titleist golf equipment of $31.0 million and in Golf gear of $5.4 million, partially offset by a decrease in FootJoy golf wear of $7.3 million. The increase in Titleist golf equipment was primarily driven by higher sales volumes of our GT drivers, fairways and hybrids as well as higher sales volumes of our 2025 Pro V1 golf ball models and higher average selling prices in golf clubs. These increases were partially offset by lower sales volumes of second model year irons, wedges and performance model golf balls. The increase in Golf gear was primarily driven by higher sales volumes, in golf gloves and golf bags, and higher average selling prices across all product categories. The decrease in FootJoy golf wear was primarily due to lower sales volumes in footwear, partially offset by higher average selling prices across all product categories. Net sales in regions outside the United States increased 0.1 percent, or 1.5 percent on a constant currency basis driven by increases in EMEA and Rest of World, partially offset by decreases in Korea and Japan. In EMEA, the increase was driven by higher net sales across all reportable segments, primarily in Titleist golf equipment, due to golf balls, and in Golf gear. In Rest of World, the increase was primarily driven by higher net sales in Titleist golf equipment and products that are not allocated to one of our three reportable segments. In Korea, the decrease was largely due to lower net sales in FootJoy golf wear, primarily footwear and apparel, and Golf gear. In Japan, the decrease was primarily due to lower net sales in FootJoy golf wear, across all product categories.

Segment Summary

Segment specifics

4.5 percent increase in net sales (4.9 percent on a constant currency basis) of Titleist golf equipment, primarily driven by higher sales volumes of our 2025 Pro V1 golf ball models and higher average selling prices in golf clubs. In addition, higher sales volumes of our latest generation GT drivers, fairways and hybrids were more than offset by lower sales volumes of our second model year wedges, irons and performance model golf balls.

• 4.2 percent decrease in net sales (3.6 percent on a constant currency basis) of FootJoy golf wear, primarily due to lower sales volumes in footwear and apparel, partially offset by higher average selling prices across all product categories.

5.0 percent increase in net sales (5.5 percent on a constant currency basis) of Golf gear driven by higher average selling prices across all product categories and higher sales volumes in golf gloves and golf bags.

Net income attributable to Acushnet Holdings Corp. improved 9.9 percent to $174.9 million, year over year, primarily due to a non-cash pre-tax gain of $20.9 million related to the deconsolidation of our FootJoy golf shoe joint venture and lower income tax expense, partially offset by lower income from operations. Adjusted EBITDA was $282.0 million, down 0.9 percent year over year. Adjusted EBITDA margin was 19.8 percent for the first six months versus 20.5 percent for the prior year period.

Outlook

Achushet for the second quarter in a row declined to provide full-year guidance due to uncertainties created by the U.S. tariff situation, but Sean Sullivan, CFO, indicated on an analyst call that sales would likely rise low-single digits in part reflecting $5 million in currency-exchange headwinds.

He also said that based on the recently announced tariff rates and agreements, Acushnet expects to have an estimated tariff impact of approximately $30 million in the second half of the year. Said Sullivan, “Our mitigation efforts include optimizing our supply chain footprint, vendor sharing programs, selective pricing actions, and cost reduction initiatives such as the VBR program. As a result, we estimate mitigating greater than 50% of the tariff impact in the second half.”

He added, “Overall, we are very pleased with the first half performance and remain focused on executing our long term strategic priorities.”

Image courtesy Titleist